Big Bear Real Estate: Prices Are Up, Sales Are Down

A Big Welcome, for those of you who are new to my newsletter.

In this edition I will be reporting on the 4th quarter stats for the overall Big Bear and Big Bear Lake Real Estate markets and break it up into different subareas. For a detailed analysis of the overall markets and the subareas, you can click on the links in the newsletter or my website tysutherland.com, that cover the overall market and each subarea.

In trying to analyze any financial market, like a real estate market, I look for trends and the reason why we are having these trends. Also, when we can expect these trends to change. And in what direction they should be changing. So, let’s take a look at the two markets. 0-$800,000 and $800,000 and up (luxury market).

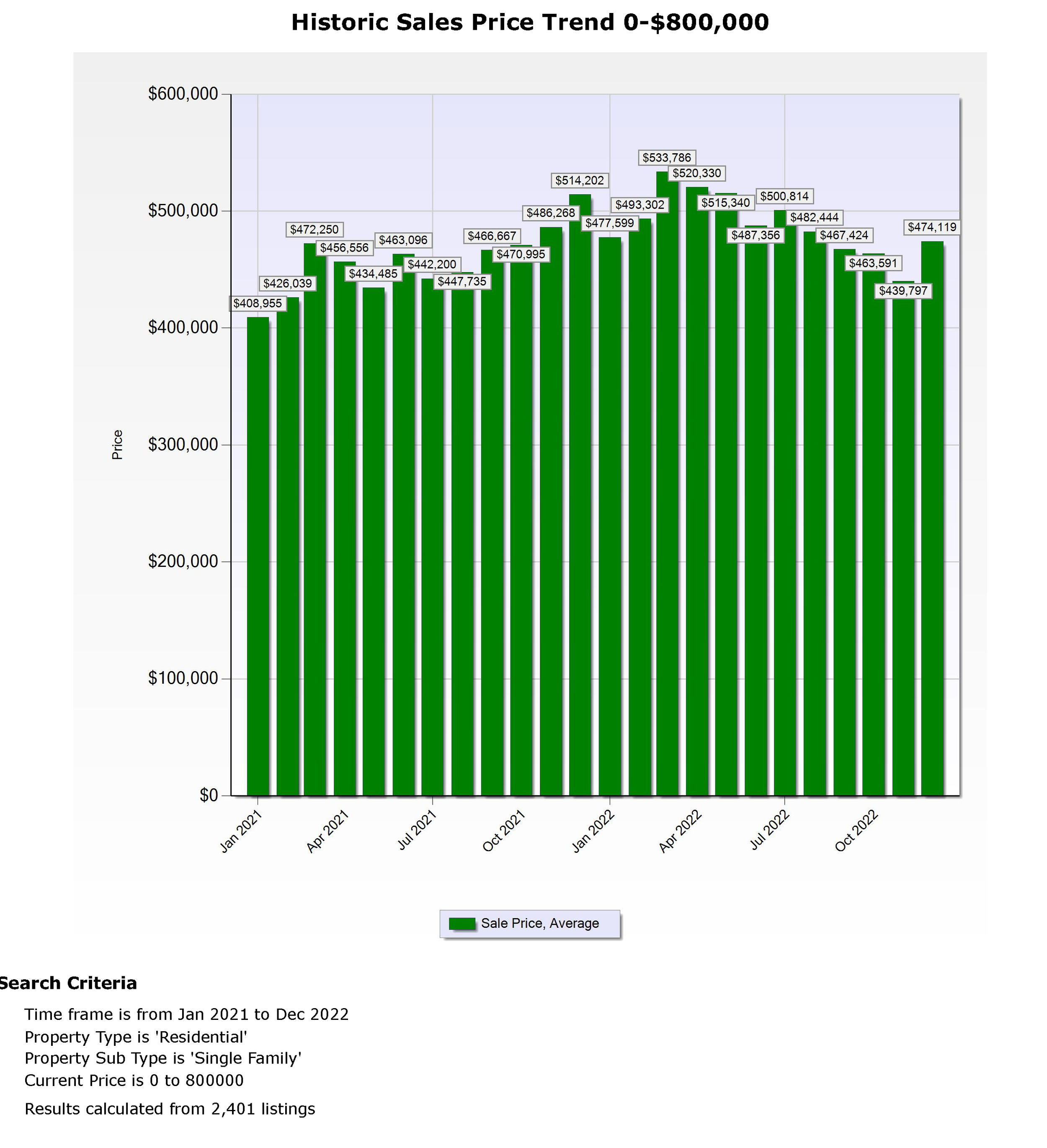

First the 0-$800,000 overall market. When I ran the stats, I was completely thrown off by what prices were doing in this market. Overall they went up by $34,000 in December compared to November. As I have written in past newsletters, because of rising interest rates we have had a steady decline in prices since March, so I wasn’t expecting to see this. See first Graph below. (To see what prices have done in the subareas this graph is available in each subarea. Some went up and some went down.) With higher interest rates hurting the market we should have a lower number of sales, which we have (See second Graph). To see what prices have done in the subareas this graph is available in each subarea. In the fourth quarter sales went from 88 to 42 (even though listings have been going up). High rates and lower sales supported the fact that we should have prices going down. So, what caused this? At this time, it is hard to say. Hopefully this is a sign of prices in this market stabilizing. We will have to see what happens in the next few months. It is welcome to see but I don’t expect this to continue. It was only 1 month.

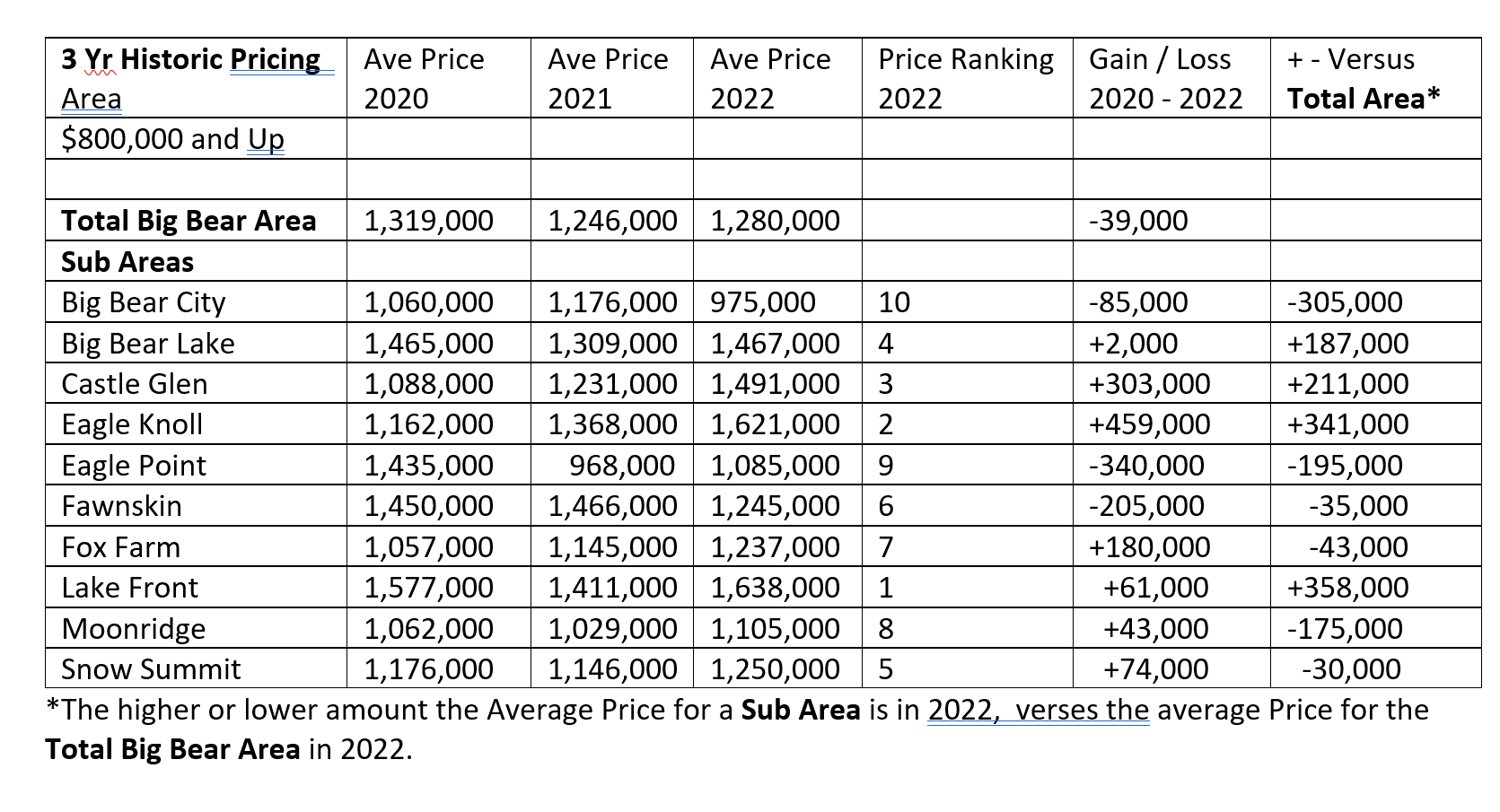

If you look at the table below graph 2 you can see how this declining market has affected the equity that was built up in the last 2 years in the Total Big Bear Area and the different subareas. Column 3 shows peak prices in 3/22. Column 4 shows the gain from 1/21 to 3/22. Column 7 shows the gain or loss from the peak price from 3/22 to 12/22. Column 8 shows gain or loss from 2 years ago 1/21 to 12/22.

Now let’s take a look at the $800,000 and up market. While the lower priced market had a nice price increase, the luxury market took a big hit in price and sales. If you look at the third graph you will see that until December prices were much more stable than in the lower priced market. But in December prices went down $270,000 from November. (To see what prices have done in the luxury subareas this graph is available in each luxury subarea.) I had been expecting a correction in the price of the luxury market, but I didn’t expect such a big decline in one month. We will have to see how this averages out over the next few months. Sales followed a steady decline in the overall luxury market down to 7, with some of the subareas having no sales for the month of December (See graph 4). With prices and sales declining this market is showing that it is still slowing down.

To see how pricing over the last 3 years has been affected by our current market in each subarea of the luxury market, you can look at column 6 in table 2 at the bottom and see the equity gain or lose for each subarea. Because of the volatility of prices in the luxury market I have used a 3-year average instead of a 2-year average like I did for the prices in the lower priced market.

Because of inflation the Fed has raised interest rates which caused mortgage rates to go from 2% to 6.25%. This combined with Big Bear being in a second home market slowed down the real estate market in Big Bear and Big Bear Lake. Until we see some relief from high mortgage rates the real estate market should continue to be slow. Hopefully we have taken most of the reduction in sales and will see sales stabilize. As far as prices we may still see a decline but here again, I think we are close to the bottom. Now that we have taken these hits all we need is for inflation to continue its trend of going down each month so the fed can start to lower interest rates.

Cabins up here are still selling. I just put one of my listings in escrow 1/19/2023. If you are thinking of selling in the near future give me a call or send me an email to see how I can set up a program to sell your cabin.